MSc in Finance

INVEST IN YOURSELFOVERVIEW

This program presents a premier academic qualification for those interested in an international career in finance in Greece and abroad. While the modern corporate world experiences cataclysmic changes and disruptions in the way that capital markets operate, our MSc in Finance program prepares aspiring and seasoned finance professionals for a successful career in the areas of banking, corporate finance, investment management, risk management and treasury management.

We offer three specialization streams, namely: 1. Investments 2. Corporate Finance 3. Fintech and Risk Management

The innovative design of the program and its market led curriculum equips students with relevant, up to date, skills and knowledge while offers a flexible program of study that enables students to choose from a variety of courses and adjust the duration of their studies according their own needs. The program is affiliated by CFA, accredited by EPAS and NECHE and regularly reviewed by both academic and practitioner committees to strike an optimum balance between theory and practice. These committees review the curriculum and the delivery methods while ensure that the program offers sufficient practical applications of the knowledge that make sense in today’s world of business. As a result of the above efforts we manage to maintain exceptionally high placement rates, reaching up to 90% in a 6-month period after graduation.

Key features of the program

- Weekday classes between 18:00 – 22:00, twice or three times per week on average

- A 12-month program (24-month part-time)

- Field trip to foreign universities and financial instructions abroad

- Interaction with international students and participation in international student exchange programs

- 8 core modules and 2 workshops

- 3 specialization streams: Investments, Corporate Finance, Fintech & Risk Management

- Assessment: group reports/presentations, case study analysis, interim tests, final exams

- Access to the state of art, Simulating Trading Room of the American College of Greece at Aghia Paraskevi Campus

- Scholarships for the CFA Exams

The MSc in Finance Is Designed for:

-

University graduates, with diverse educational backgrounds and work experience, wishing to launch a career in finance.

-

Professionals who hold finance- related positions and want to enhance their professional status.

You may find here more information about the Program's Intended Learning Outcomes

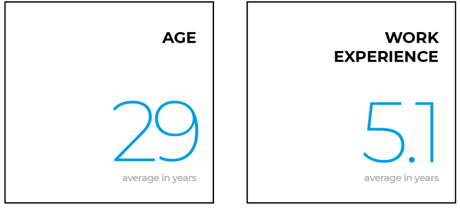

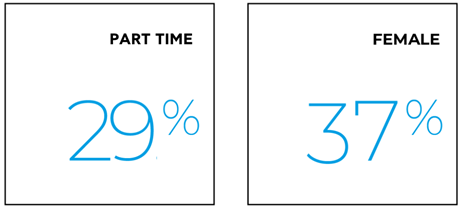

Class Profile

HIGHLIGHTS

International Recognition: Accredited by The New England Commission of Higher Education (NECHE) and EFMD accredited.

Combination of academic rigor, relevant industry knowledge and technical skill development to address participants’ professional needs and aspirations through three specialization streams, namely (1) Investments, (2) Corporate Finance, and (3) Fintech & Risk Management.

Broad and deep understanding of finance in global context and a firm grasp of the latest financial theories and techniques.

Emphasis on the practical applications of finance theories in solving actual problems.

Regular review and continuous quality assessment of the program conducted by academic and practitioners steering committees.

Develops analytical skills required for a successful career in Finance: The program culminates with the capstone course (depending on the selected stream, either “Equity Valuation” or “Credit Risk Modeling and Data Analytics”)

Access to the ACG's Simulated Trading Room that provides a real sense of technological sophistication, bringing financial markets to the students’ fingertips through cutting-edge software along with the appropriate hardware.

Exceptionally high rates of employment after graduation.

CFA University Affiliation Program:

Alba has been welcomed in the CFA Institute University Affiliation Program. Our MSc in Finance has been acknowledged as incorporating at least 70 percent of the CFA Program Candidate Body of Knowledge (CBOK) and placing emphasis on the CFA Institute Code of Ethics and Standards of Practice within the program. This program positions students well to obtain the Chartered Financial Analyst® designation, which has become the most respected and recognized investment credential in the world.

Entry into the CFA Institute University Affiliation Program signals to potential students, employers, and the marketplace that ALBA’s curriculum is closely tied to professional practice and is well-suited to preparing students to sit for the CFA examinations. Through participation in this program, ALBA is eligible to receive a limited number of student scholarships for the CFA Program each year.

Pathway collaboration with MIT on the MITx MicroMasters program in Finance

We are the only educational institution in Greece that has a pathway collaboration with MIT on the MITx MicroMasters program in Finance. Based on this collaboration, the holders of this particular MITx MicroMasters credential could apply for admission at the Alba MSc in Finance and, upon acceptance, will be awarded up to 25% of the academic units in the MSc coursework.

FULL TIME

MSc in Finance Program Total Year Schedule 2025-2026

US Credits: 30

You may find the Graduate Academic Calendar 2025–26 here.

*The school reserves the right to reexamine the structure of all academic programs and proceed to any necessary changes in the total year schedule.

**Students who have passed all three levels of CFA program exams are eligible for receiving exemptions in the following core courses of the Alba MSc in Finance program: (1) Corporate Finance & Valuation (2) Portfolio Management.

1st Period | Fall 2025

Financial Accounting & Reporting

2

With the aim of evaluating corporate financial performance and making financially rational decisions, this course introduces students to financial accounting, reporting and analysis. This module aims to develop awareness in students of the way in which accounting is embedded in a particular socio-economic, political and cultural context and challenges the perception that accounting is a purely technical, uninterested and neutral practice. Within this framework, the module seeks to provide students with a broad introduction to the need for external accounting systems, the principles explicit and implicit within such systems, and the strengths and weaknesses in such systems.

Quantitative Tools in Finance

2

This course aims to introduce in an intuitive and rigorous way the fundamental mathematical and statistical tools of financial analysis, portfolio investment and risk management. Topics covered include basic statistical principles and mathematical operations, probability theory, discrete and continuous distributions, inferential statistics (confidence intervals hypothesis testing) and regression. Moreover, students will use statistical software including Excel’s Data Analysis ToolPak and Stata to perform complex statistical analysis.

Corporate Finance & Valuation

2.5

This course covers the application of the net present value rule and other criteria for project appraisal, the use of discounted cash flow and other valuation models in making investment decisions, risk, return and capital budgeting under uncertainty, the cost of capital and capital structure, dividend policy and how firms issue securities.

Portfolio Management

2

This course addresses topics in capital asset allocation, the history of risk and return, asset pricing theories (CAPM, APT, Consumption based asset pricing), market efficiency, the predictability of asset returns, the term structure of interest rates and bond portfolio management, futures and options, international portfolio management and performance measurement and evaluation.

Economic Policy & Capital Markets

1.5

The course aims to provide students with a solid understanding of the interactions between the macroeconomic environment and capital markets. In particular, it will cover the role of macroeconomic mechanisms and the international political economy in shaping risks and opportunities across financial assets. The course also includes case studies and class discussions on how global economic events are covered by the financial press.

Business Writing

0.5

The purpose of the workshop is to address the question ‘what is the skill of writing?’. According to the American writer Edwin Schlossberg, “the skill of writing is to create a context in which other people can think”. The workshop explores this statement. This exploration and subsequent understanding is of paramount importance for any business activity, since much of the communication in the business world takes place in writing, usually within tight deadlines, ranging from short, simple e-mails to long, rich documents. The salient gain of the participants from the workshop is the understanding of different modes and purposes of writing, as well as of different types and purposes of documents. The main topics covered during the workshop include: the requirements of different types of documents, such as reports, case studies, research papers and proposals, proper referencing, and the research process.

2nd Period | Winter 2026 | Select one stream - from the three streams listed below - and choose two courses from the other two streams as electives

Financial Data Analytics with Python | Investments stream

1

This course offers an introduction to using Python (a fast-growing, open-source programming language) in financial data analysis. More specifically, this course covers the basics of coding with Python, as well as the use of various Python libraries for the purposes of numerical computing, data analysis, data wrangling and data visualization.

Fixed Income Securities | Investments stream

2

The aim of this course is to provide students with a thorough understanding of fixed income instruments and bond portfolio management. It covers the theories of the term structure, estimation of the term structure of interest rates (spot and forward), passive bond portfolio strategies (immunization, cash flow matching, contingent immunization, bond index funds), active portfolio strategies (interest rate forecasting, bullet, barbell and ladder strategies), bond portfolio risk management (single duration, convexity, and multi-factor models of the term structure of interest rates).

Advanced Asset Pricing | Investments stream

2

This course aims to develop and sharpen students financial modelling skills. It brings together statistical and decision analytical frameworks such as regression analysis and optimisation with finance theory and information technology. It helps participants to deepen their understanding of finance concepts through the development of a wide range of financial models in areas such as cash flow modelling, risk analysis, portfolio optimisation, and option pricing. It is a practical course based on instructed computer workshops. These workshops focus on financial modelling with excel, including scenario and sensitivity analysis, risk analysis using @Risk, optimisation with Solver, and the development of VBA functions.

Two elective courses (from streams 2 and 3)

4

Financial Data Analytics with Python | Corporate Finance stream

1

This course offers an introduction to using Python (a fast-growing, open-source programming language) in financial data analysis. More specifically, this course covers the basics of coding with Python, as well as the use of various Python libraries for the purposes of numerical computing, data analysis, data wrangling and data visualization.

Corporate Treasury Management | Corporate Finance stream

2

This course applies the modern theory of Finance to the management of the corporation's short-term assets and liabilities. It discusses working capital management, short-term borrowing and investment strategies, as well as corporate risk management. Topics covered under these headings include: optimal inventory management, trade credit and the management of credit risk, optimal cash management, the choice between private and public funding, different forms of bank borrowing sources and their use, the measurement and management of accounting, transactions and economic exposure, multinational working capital management, financing of foreign operations, interest rate and currency swaps, interest rate and currency options, capital budgeting and the cost of capital for multinationals and the measurement and management of political risk.

Advanced Corporate Finance | Corporate Finance stream

2

This course builds on the Corporate Finance and Valuation course to examine the way companies raise debt and equity capital both in private and global capital markets, mergers and acquisitions, and corporate restructuring. The relationships between the interests of corporate managers, shareholders and lenders, as well as issues of corporate governance, are an important part of the course content.

Two elective courses (from streams 1 and 3)

4

Financial Data Analytics with Python | Fintech & Risk Management stream

1

This course offers an introduction to using Python (a fast-growing, open-source programming language) in financial data analysis. More specifically, this course covers the basics of coding with Python, as well as the use of various Python libraries for the purposes of numerical computing, data analysis, data wrangling and data visualization.

Financial Risk Management | Fintech & Risk Management stream

2

Financial risk management (FRM) has gone through enormous changes since its inception in the late 1970s. From its origins as a cash flow matching technique, FRM has now instituted the use of advanced analytical techniques, quantitative finance tools as well as sophisticated pricing formulas and hedging strategies. The module focuses on the management of financial intermediaries, and aims to analyze financial risks such as interest rate risk, FOREX and market risk, choose appropriate hedging strategies and monitor their implementation. The prime objective is to provide a) a thorough grounding in the way banks and insurance firms operate, b) the necessary theoretical knowledge and statistical tools to measure different kinds of risks, and c) a comprehensive examination of the techniques and instruments for managing those risks in the banking and insurance industry.

Finance Digitalization | FinTech & Risk Management stream

2

The main objective of this course is to provide an insight to the recent trends and developments in the financial services industry addressing the main challenges and solutions related to the FinTech landscape. The students who attend this course will be equipped to deal with the existing finance ecosystems by developing valuable skills in new FinTech applications such as lending and personal finance, crowd-funding and business financing, payments and retail transactions, various types of cryptocurrencies, and banking infrastructure and tools.

Two elective courses (from streams 1 and 2)

4

3rd Period | Spring 2026 | Follow your selected stream - Investments stream

Business Ethics & CSR | Investments stream

1

Understanding the ethical basis of human behaviour is of fundamental importance for building commitment to organizational goals and for imparting integrity and a sense of the common good in organizational members. The course examines a broad array of matters relating to ethics, including: individual and organizational obstacles to ethics; ethics information processing methods and judging theories; an action-learning framework for ethics leadership; adversarial win-lose ethics methods; integrative win-win ethics methods; dialogic transcendent ethics method; reflection and developing personal and contingency ethics leadership approaches; developing on ethics leadership action-learning plan. The course focuses also on sustainability, corporate social responsibility and corporate accountability with further emphasis placed on business strategies that aim to create long term value and a positive environmental, social and economic impact. Actionable knowledge is achieved by applying theory in real life situations through critical analysis and debating on prominent cases and in class discussions on current trends and developments on sustainable business activities.

Equity Valuation | Investments stream

4

The Program culminates with theEquity Valuation course. The purpose of this course is to provide practical valuation tools for valuing and analyzing companies and give students a real world view of the role and activities of an equity security analyst. The course integrates the theoretical knowledge acquired during the course and the practical input from leading financial analysts to understand the process of analyzing companies and the valuation process. Students will be introduced to the practice of modern financial analysis from leading financial analysts and will be given the opportunity to apply their skills by valuing a company of their choice. Upon completion of the course students are expected to be able to use modern valuation techniques, appreciate the linkage between strategic business analysis, financial accounting, corporate finance and the macroeconomic environment, understand and utilize the information in financial statements and prepare a valuation report in different contexts (security analysis, initial public offerings, credit analysis and mergers and acquisitions).

Alternative Investments & Sustainable Finance | Investments stream

1.5

The purpose of this course is to present the principles of alternative investments, aiming to equip students with the ability to effectively utilize outside capital. It covers the execution and evaluation of classic and new hedge fund strategies, alongside comprehensive risk management techniques, including an in-depth focus on climate risk and sustainable ESG investments. Students will learn through both theoretical and practical perspectives, including detailed analysis of various alternative investment classes such as venture capital, real estate, and artwork, emphasizing their significance in diversified portfolios. Additionally, the curriculum integrates the principles of sustainable investment, exploring how environmental, social, and governance factors influence investment decisions and market trends. The course systematizes knowledge on investment categories and analyzes the global market's current state and future development prospects of alternative investments, including the growing importance of sustainability in financial strategies. This prepares students for adept investment management in a dynamically evolving financial landscape

Master Thesis

4

The MSc Thesis is a research project of a student’s special interest in a faculty member’s area of expertise. The students will have the opportunity to construct a detailed plan of a research project; to review specific literature on the selected topic; to identify relevant research questions from the literature; to be able to turn general research questions into empirical ones; to select and justify an appropriate research design; to select and employ suitable methods or techniques to investigate the empirical questions; to analyze financial or social data and to write a report covering a review of the relevant literature, the research questions, an explanation and justification of the design, a description of the conduct and analysis of the research, and a discussion of the findings in relation to the literature and methodological issues.

Internship

4

An Internship brings together the academic with the business world, providing benefits both to students and to companies. It has the status of a course, hence it is an obligatory requirement for the fulfilment of the M.Sc. Degree, it carries credits and it is graded. The expected duration is three (3) months, from beginning March to end May.

The benefits for students include the opportunity for the blending of academic and on-the-job learning; the use of the explicit knowledge gained during the program, the attainment of tacit knowledge, the development and diversification of skills, the acquisition of work experience, the identification and/or refinement of career goals, the creation and/or development of a professional network. The benefits for companies include the opportunity to meet some company needs with highly qualified and motivated students, the identification of talent for potential future employment, the enrichment of current perspectives and practices with the intern’s novel ideas, the enhancement of social responsibility activities.

3rd Period | Spring 2026 | Follow your selected stream - Corporate Finance stream

Business Ethics & CSR | Corporate Finance stream

1

Understanding the ethical basis of human behaviour is of fundamental importance for building commitment to organizational goals and for imparting integrity and a sense of the common good in organizational members. The course examines a broad array of matters relating to ethics, including: individual and organizational obstacles to ethics; ethics information processing methods and judging theories; an action-learning framework for ethics leadership; adversarial win-lose ethics methods; integrative win-win ethics methods; dialogic transcendent ethics method; reflection and developing personal and contingency ethics leadership approaches; developing on ethics leadership action-learning plan. The course focuses also on sustainability, corporate social responsibility and corporate accountability with further emphasis placed on business strategies that aim to create long term value and a positive environmental, social and economic impact. Actionable knowledge is achieved by applying theory in real life situations through critical analysis and debating on prominent cases and in class discussions on current trends and developments on sustainable business activities.

Equity Valuation | Corporate Finance stream

4

The Program culminates with theEquity Valuation course. The purpose of this course is to provide practical valuation tools for valuing and analyzing companies and give students a real world view of the role and activities of an equity security analyst. The course integrates the theoretical knowledge acquired during the course and the practical input from leading financial analysts to understand the process of analyzing companies and the valuation process. Students will be introduced to the practice of modern financial analysis from leading financial analysts and will be given the opportunity to apply their skills by valuing a company of their choice. Upon completion of the course students are expected to be able to use modern valuation techniques, appreciate the linkage between strategic business analysis, financial accounting, corporate finance and the macroeconomic environment, understand and utilize the information in financial statements and prepare a valuation report in different contexts (security analysis, initial public offerings, credit analysis and mergers and acquisitions).

Alternative Investments & Sustainable Finance | Corporate Finance stream

1.5

The purpose of this course is to present the principles of alternative investments, aiming to equip students with the ability to effectively utilize outside capital. It covers the execution and evaluation of classic and new hedge fund strategies, alongside comprehensive risk management techniques, including an in-depth focus on climate risk and sustainable ESG investments. Students will learn through both theoretical and practical perspectives, including detailed analysis of various alternative investment classes such as venture capital, real estate, and artwork, emphasizing their significance in diversified portfolios. Additionally, the curriculum integrates the principles of sustainable investment, exploring how environmental, social, and governance factors influence investment decisions and market trends. The course systematizes knowledge on investment categories and analyzes the global market's current state and future development prospects of alternative investments, including the growing importance of sustainability in financial strategies. This prepares students for adept investment management in a dynamically evolving financial landscape

Financial Econometrics | Corporate Finance stream

1.5

The course will cover a number of time-series techniques that can be applied to the study of financial economics. Specifically, the topics covered in this course will include: linear stochastic time series models and their applicability to financial data; the existence of unit-root processes in financial and macro-economic data; the application of co-integration techniques to financial data; the application of ARCH and GARCH techniques in modelling volatility in financial markets; and the application of stochastic volatility techniques in financial markets.

Master Thesis

4

The MSc Thesis is a research project of a student’s special interest in a faculty member’s area of expertise. The students will have the opportunity to construct a detailed plan of a research project; to review specific literature on the selected topic; to identify relevant research questions from the literature; to be able to turn general research questions into empirical ones; to select and justify an appropriate research design; to select and employ suitable methods or techniques to investigate the empirical questions; to analyze financial or social data and to write a report covering a review of the relevant literature, the research questions, an explanation and justification of the design, a description of the conduct and analysis of the research, and a discussion of the findings in relation to the literature and methodological issues.

Internship

4

An Internship brings together the academic with the business world, providing benefits both to students and to companies. It has the status of a course, hence it is an obligatory requirement for the fulfilment of the M.Sc. Degree, it carries credits and it is graded. The expected duration is three (3) months, from beginning March to end May.

The benefits for students include the opportunity for the blending of academic and on-the-job learning; the use of the explicit knowledge gained during the program, the attainment of tacit knowledge, the development and diversification of skills, the acquisition of work experience, the identification and/or refinement of career goals, the creation and/or development of a professional network. The benefits for companies include the opportunity to meet some company needs with highly qualified and motivated students, the identification of talent for potential future employment, the enrichment of current perspectives and practices with the intern’s novel ideas, the enhancement of social responsibility activities.

3rd Period | Spring 2026 | Follow your selected stream - Fintech & Risk Management stream

Business Ethics & CSR | Fintech & Risk Management stream

1

Understanding the ethical basis of human behaviour is of fundamental importance for building commitment to organizational goals and for imparting integrity and a sense of the common good in organizational members. The course examines a broad array of matters relating to ethics, including: individual and organizational obstacles to ethics; ethics information processing methods and judging theories; an action-learning framework for ethics leadership; adversarial win-lose ethics methods; integrative win-win ethics methods; dialogic transcendent ethics method; reflection and developing personal and contingency ethics leadership approaches; developing on ethics leadership action-learning plan. The course focuses also on sustainability, corporate social responsibility and corporate accountability with further emphasis placed on business strategies that aim to create long term value and a positive environmental, social and economic impact. Actionable knowledge is achieved by applying theory in real life situations through critical analysis and debating on prominent cases and in class discussions on current trends and developments on sustainable business activities.

Credit Risk Modeling & Data Analytics | Fintech & Risk Management stream

4

The main objective of this course is to provide an insight to credit risk and strengthen the analytical skills required in credit risk modelling. The course is structured to cover topics in credit risk, both at the individual level and the portfolio level. Financial industry’s popular credit models will also be discussed. Furthermore, the course will introduce credit analytics (e.g. credit scorecards) using a statistical software.

Financial Econometrics | Fintech & Risk Management stream

1.5

The course will cover a number of time-series techniques that can be applied to the study of financial economics. Specifically, the topics covered in this course will include: linear stochastic time series models and their applicability to financial data; the existence of unit-root processes in financial and macro-economic data; the application of co-integration techniques to financial data; the application of ARCH and GARCH techniques in modelling volatility in financial markets; and the application of stochastic volatility techniques in financial markets.

Master Thesis

4

The MSc Thesis is a research project of a student’s special interest in a faculty member’s area of expertise. The students will have the opportunity to construct a detailed plan of a research project; to review specific literature on the selected topic; to identify relevant research questions from the literature; to be able to turn general research questions into empirical ones; to select and justify an appropriate research design; to select and employ suitable methods or techniques to investigate the empirical questions; to analyze financial or social data and to write a report covering a review of the relevant literature, the research questions, an explanation and justification of the design, a description of the conduct and analysis of the research, and a discussion of the findings in relation to the literature and methodological issues.

Internship

4

An Internship brings together the academic with the business world, providing benefits both to students and to companies. It has the status of a course, hence it is an obligatory requirement for the fulfilment of the M.Sc. Degree, it carries credits and it is graded. The expected duration is three (3) months, from beginning March to end May.

The benefits for students include the opportunity for the blending of academic and on-the-job learning; the use of the explicit knowledge gained during the program, the attainment of tacit knowledge, the development and diversification of skills, the acquisition of work experience, the identification and/or refinement of career goals, the creation and/or development of a professional network. The benefits for companies include the opportunity to meet some company needs with highly qualified and motivated students, the identification of talent for potential future employment, the enrichment of current perspectives and practices with the intern’s novel ideas, the enhancement of social responsibility activities.

PART TIME

MSc in Finance Program Total Year Schedule 2025-2027

1st Period | Fall 2025

Quantitative Tools in Finance

2

Corporate Finance & Valuation

2.5

Portfolio Management

2

Business Writing

0.5

2nd period | Winter 2026 | Select one stream - from the three streams listed below

Financial Data Analytics with Python | Investments stream

1

Fixed Income Securities | Investments stream

2

Financial Data Analytics with Python | Corporate Finance stream

1

Corporate Treasury Management | Corporate Finance stream

2

Financial Data Analytics with Python | Fintech & Risk Management stream

1

Financial Risk Management | Fintech & Risk Management stream

2

3rd Period | Spring 2026 | Follow your selected stream

Business Ethics & CSR | Investments stream

1

Alternative Investments & Sustainable Finance | Investments stream

1.5

Business Ethics & CSR | Corporate Finance stream

1

Alternative Investments & Sustainable Finance | Corporate Finance stream

1.5

Financial Econometrics | Corporate Finance stream

1.5

Business Ethics & CSR | Fintech & Risk Management stream

1

Financial Econometrics | Fintech & Risk Management stream

1.5

4th Period | Fall 2026

Financial Accounting & Reporting

2

Economic Policy & Capital Markets

1.5

5th Period | Winter 2027 | Select one stream - from the three streams listed below - and choose two courses from the other two streams as electives

Advanced Asset Pricing | Investments stream

2

Two elective courses (from streams 2 and 3)

4

Advanced Corporate Finance | Corporate Finance stream

2

Two elective courses (from streams 1 and 3)

4

Finance Digitalization | FinTech & Risk Management stream

2

Two elective courses (from streams 1 and 2)

4

6th Period | Spring 2027 | Follow your selected stream

Equity Valuation | Investments stream

4

Master Thesis

4

Internship

4

Equity Valuation | Corporate Finance stream

4

Master Thesis

4

Internship

4

Credit Risk Modeling & Data Analytics | Fintech & Risk Management stream

4

Master Thesis

4

Internship

4

FACULTY

Dr. Zarkos has teaching and research interests in the areas of Corporate Finance, Financial Management, Capital Budgeting, Real Options, Management Accounting and Strategy. His research focuses on new applications of real options in management decision making and the development of decision techniques in Corporate Finance and Strategy literature.

alba profile linkCAREER

After completing the Program participants should be able to:

- Comprehend qualitatively and quantitatively the core areas of finance;

- Understand current trends and practices in the financial industry;

- Understand and critically evaluate the practical applications of financial theories and techniques and how they are used in the financial industry;

- Apply the techniques and methods of finance to conduct independent research projects;

- Display strong analytical and communication skills;

- Appreciate the importance of business ethics and corporate social responsibility;

- Make use of the latest technology to design and perform new applications in corporate finance, risk management and investment/retail banking.

SCHOLARSHIPS

You can secure pre-approval of your scholarship, before you apply for admission to the MBA or MSc program of your choice.

GMAT Scholarships

Scholarships of 40% for MBAs and MSc programs for GMAT ≥ 645

Theodore Papalexopoulos Scholarship

Partial scholarships, based on a combination of academic/professional excellence, high academic & professional potentials and presence of financial need.

Ulysses Kyriakopoulos Expendable Scholarship

Partial scholarships, based on a combination of academic/professional excellence, high academic & professional potentials and presence of financial need.

NielsenIQ Scholarship

Partial scholarship(s) for various MBA & MSc programs.

The Chris Argyris Scholarships

Two (2) partial scholarships amounting to 50% of total tuition fees for various MSc Programs, based on a combination of academic performance & potential.

Next Generation Family Business Scholarship

One (1) merit-based partial awarded to a member of the next generation of a family business for several MBA & MSc programs

Leventis Foundation Scholarships

Full scholarships for Nigerian nationals for the Alba MBA & MSc in Finance

SEV (Hellenic Federation of Enterprises) Scholarships

Partial scholarships of 50% to Enterprises members of SEV, offered as rewarding services to the members of the Federation.

Triton Scholarship

Two (2) partial scholarships up to 50% for MSc in Finance program

ADMISSION REQUIREMENTS

To be considered for admission, candidates must:

- Hold a bachelor degree, or be a Chartered Financial Analyst (CFA chart holder), or have passed all three levels of CFA exams;

- Provide evidence of excellent command of the English language;

- Need to be currently employed or self-employed (valid for the part time mode only);

- GMAT Focus Edition test is optional unless the Academic Committee requires the applicant to take it: in any case, scores of 515 or more (GRE >155) can strengthen your application and help you secure a merit scholarship.

Candidates must submit:

- The completed application form, including one recent photograph in jpeg format;

- Two letters of recommendation in Greek or in English language;

- Official academic transcripts as well as certified copies of degrees from each undergraduate, graduate or professional degree earned;

- Proof of competence in the English language (unless schooled in English): Proficiency (Cambridge Proficiency, Michigan Proficiency, MSU Proficiency), or TOEFL, or IELTS, or Duolingo English Test;

- Three essays, as indicated in the Application form;

- Receipt of the non-refundable application fee's [€60] deposit.

Click here to download the details for admission.

For details on academic policy, course credit policy, fee policy, and rules for student conduct, please refer to the Student Handbook .

Additionally, the School's Students Code of Conduct can be found here.

REQUEST A BROCHURE

Fill in this form for a copy of the brochure

CONTACT

We urge applicants to request further information or to come for a meeting at our downtown campus, in order to better understand their profile and motivations.

Just fill out and submit the form below and we will respond to you as quickly as possible.

Tel.: +30 210 89.64.531 ext. 2289

e-mail: [email protected]